2021年12月29日召开的国务院常务会议,决定延续实施部分个人所得税优惠政策,将全年一次性奖金不并入当月工资薪金所得、实施按月单独计税的政策延至2023年底。

The executive

meeting of the State Council held on December 29 decided to continue the

implementation of some preferential policies on personal income tax, and extend

the policy of excluding the one-time bonus of the whole year from the salary

income of the current month and separate monthly tax until the end of 2023.

为了使修改后的个税法平稳落地,在2023年12月31日前取得的全年一次性奖金,将不并入当年综合所得,以全年一次性奖金收入处以12个月得到的数额,按照相应的综合所得税率表,确定适用税率和速算扣除数, 单独计算纳税。

In order to ensure

the smooth implementation of the revised individual income tax law, the annual

one-time bonus obtained before December 31, 2023 will not be incorporated into

the comprehensive income of the current year. The applicable tax rate and quick

calculation deduction shall be determined according to the corresponding

comprehensive income tax rate table based on the annual one-time bonus income

obtained for 12 months, and the tax shall be calculated separately.

2024年1月1日起, 年终奖要并入计算全年综合所得。如果年终奖过高,后者可能会导致全年税率变高。

From January 1,

2024, the year-end bonus shall be incorporated into the annual comprehensive

income. If the year-end bonus is too high, the latter may lead to a higher

annual tax rate.

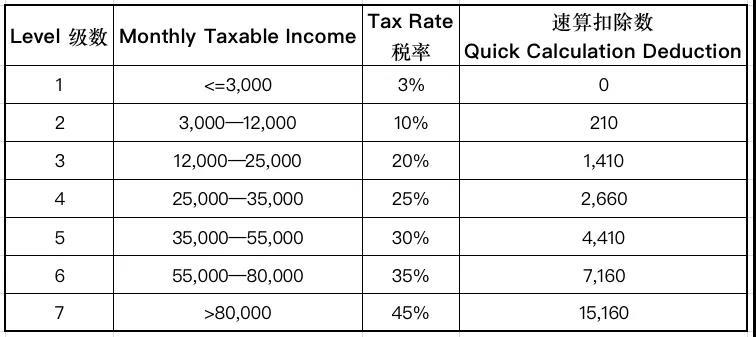

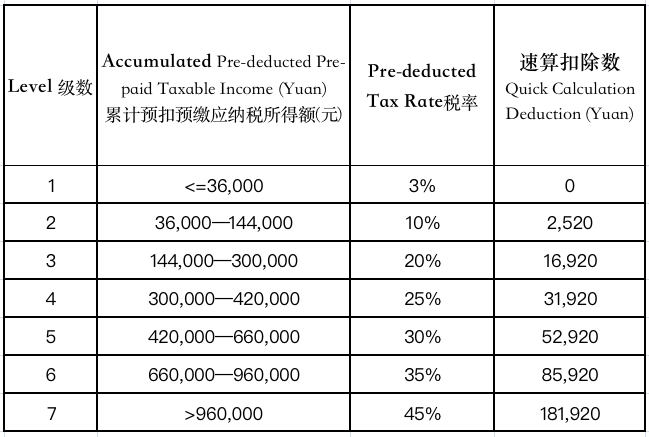

合并计算后的税率表如下(起征点6万)

The consolidated tax

rate table is as follows (starting point: 60,000 yuan)

现在我们一起通过三个案例来看一下对于不同薪资收入结构的人群,新方法和旧方法会有怎样的影响。

Now let’s have a

look of three cases that can explain how the new method would affect the total

tax payment for employees with different income packages。

Case 1

Alex

Monthly salary: 10,000 (after social insurance and public

housing fund, special additional deduction)

Annual bonus: 100,000 yuan

月薪:1万元(扣除五险一金,专项附加扣除等)

年终奖:10万元

The Old Method

Calculation formula: annual taxable

income=monthly salary tax payable + annual bonus tax payable

Alex’s annual salary income tax payable

=(100,000*12 – 60,000)*10% - 2,520 = 3,480 (yuan)

Alex’s annual bonus tax payable= annual

bonus*relevant tax rate –

quick calculation deduction=100,000*10%-210=9,790

(yuan)

Alex’s total annual income tax

payable=3,480+ 9,790 =13,270 (yuan)

老办法

计算公式:全年总应纳税额=工资所得缴税+年终奖缴税

Alex全年工资所得应纳个人所得税=(1万 *12 -6万)*10% -

2520 = 3480 元

年终奖应纳税额=

全年一次性奖金收入^ 适用税率-速算扣除数

Alex年终奖应缴个人所得税:

10万*10%-210 =9790元

年度总交个人所得税:

3480+9790=13270元

The New Method

Calculation formula:

Annual total income tax payable=(annual

salary + annual bonus – 60,000 tax free income) * relevant tax rate – quick

calculation deduction

= (10,000*12 + 100,000 – 60,000) *20% -

16,920 = 15,080 (yuan)

新办法

计算公式

全年总应纳税额=(年薪+年终奖-6万元起征点)*适用税率-速算扣除数

全年纳税=

(1万*12+10万-6万)*20%-16920=15080元

Therefore, Alex will have to pay 15,080- 13,270=1,810

(yuan) MORE income tax under the new policy with the same remuneration package

However, for those who’s salary is lower than annual

bonus, the new method is beneficial

Case 2

Ben

Monthly salary: 10,000 (after social insurance and public

housing fund, special additional deduction)

Annual bonus: 200,000 yuan

月薪:1万元(扣除五险一金,专项附加扣除等)

年终奖:20万元

The Old Method

Calculation formula: annual taxable

income=monthly salary tax payable + annual bonus tax payable

Ben’s annual salary income tax payable

=(100,000*12 – 60,000)*10% - 2,520 = 3,480 (yuan)

Ben’s annual bonus tax payable= annual

bonus*relevant tax rate –

quick calculation deduction=200,000*20%-1410=38,590

(yuan)

Ben’s total annual income tax

payable=3,480+ 38,590 =42,070 (yuan)

老办法

计算公式:全年总应纳税额=工资所得缴税+年终奖缴税

Ben全年工资所得应纳个人所得税= (1万

*12 -6万)*10% - 2520 = 3480 元

年终奖应纳税额=

全年一次性奖金收入^ 适用税率-速算扣除数

Ben年终奖应缴个人所得税:

20万*20%-1410 =38590元

年度总交个人所得税:

3480+38590=42070元

The New Method

Calculation formula:

Annual total income tax payable=(annual

salary + annual bonus – 60,000 tax free income) ^ relevant tax rate – quick

calculation deduction

= (10,000?12 + 200,000 – 60,000) ^20% -

16920 = 35,080 (yuan)

新办法

计算公式

全年总应纳税额=(年薪+年终奖-6万元起征点)*适用税率-速算扣除数

全年纳税=

(1万*12+20万-6万)*20%-16920=35080元

With new policy, Ben’s income tax is REDUCED to

42,070-35,080=6,990 (yuan)

新计算规则下,Ben的个税少缴纳6990元

For those who’s annual bonus is less than 36,000 yuan,

and total income minus social insurance and special deduction less than 96,000

yuan, no affection

对于年终奖少于36000元,且年终奖+年薪(五险一金,专项附加扣除)少于96000的人群来说,没有影响。

Case3

Charles

Monthly salary: 5,000 (after social insurance and public

housing fund, special additional deduction)

Annual bonus: 36,000 yuan

月薪:5千元(扣除五险一金,专项附加扣除等)

年终奖:3.6万元

The Old Method

Calculation formula: annual taxable

income=monthly salary tax payable + annual bonus tax payable

Charles annual salary income tax payable

=(5,000*12 – 60,000) = 0

(yuan)

Charles’s annual bonus tax payable= annual

bonus*relevant tax rate –

quick calculation deduction=36,000*3%=1,080 (yuan)

Alex’s total annual income tax

payable=0+1,080 =1,080 (yuan)

老办法

计算公式:全年总应纳税额=工资所得缴税+年终奖缴税

Charles全年工资所得应纳个人所得税= (5千 *12 -6万)= 0 元

年终奖应纳税额=

全年一次性奖金收入* 适用税率-速算扣除数

Charles年终奖应缴个人所得税:

3.6万*3% =1080元

年度总交个人所得税:

0+1080=1080元

The New Method

Calculation formula:

Annual total income tax payable=(annual

salary + annual bonus – 60,000 tax free income)*relevant tax rate – quick calculation

deduction

= (5,000*12 + 136,000 – 60,000) *3% = 1,080 (yuan)

新办法

计算公式

全年总应纳税额=(年薪+年终奖-6万元起征点)*适用税率-速算扣除数

全年纳税=

(5千*12+3.6万-6万)*3%=1080元

It is now clear to tell that for

higher income person, the new method might be good news. However,

it is always better to consult professional when before making decisions about

remuneration packages and make tax plans.

综上,可见对于高收入人群,这可能是好消息。但是,在做薪资决定和策划税务之前,咨询专业人士总是更好的选择。