The current Individual Income Tax Law allows foreigners to enjoy allowances, such as rental, meal, children’s school fees, and so on, which can be deducted from the taxable income; therefore, reducing the individual income tax (IIT) payable.

当前的个人所得税法允许外国人享受免税补贴,例如,房租,餐补,子女的学费等,可以从计算个税的基数中扣除,从而减免需缴纳的个税总额。

To be precise, from January 1st , 2019 to December 31st , 2021, foreigners in compliance with the qualification as residence, can choose to have individual income tax special additional deduction, or to enjoy allowances on housing, language training, children’s education and other tax free subsidies. Once the foreigner chosen the type, within one taxable year, the choice cannot be altered.

具体来说,自2019年1月1日至2021年12月31日,外籍人士符合居民身份的,可以选择享受个人所得税专项附加扣除,或享受住房补贴,语言训练费,子女教育费用等补贴免税优惠政策。外籍人士一担选择,在一个纳税年度内不得变更。

Since January 1st 2022, the option would be gone. One can only have the individual income tax special additional deduction just like local residents, there will be no more special treatment for foreigners living in China considered as residents on individual income taxation.

自2022年1月1日起,这项选择将不复存在。外籍人士只能使用个人所得税专项附加扣除,在个人所得税项目上,外籍人士将不再享受任何优待。

To be precise, from January 1, 2022, the allowances currently available for foreign professionals become fully taxed. This means that the allowances will become part of the gross salary and, as such, be taxed at the related tax bracket.

确切地说,从2022年1月1日起,目前可供外国专业人员使用的津贴将全额征税。这意味着津贴将成为工资总额的一部分,因此,将按相关税级征税。

The result of this is that, either the employee will receive a much lower net salary (since the allowances will effectively become part of the salary and won’t be separated any longer), or the company cost on the employee will nearly double (given that a 45% IIT will likely apply to the overall salary package).

这样做的结果是,要么员工将获得更低的净工资(因为津贴将实际上成为工资的一部分,不再分离),要么员工的公司成本将几乎翻一番(考虑到45%的个人所得税可能适用于整体工资包)。

For most expats maybe it will not be as high as 45%, yet the increase in tax can be still substantial.

可能大部分外籍人士并不会达到45%这一比例,但是增加的税收部分还是很显著的。

Reindeer Station’s tax expert made a case to explain the change.

灵达商务的税务专家做了一个案例来解释区别。

Case Study

案例

One expat working in Ningbo fits the resident profile, hence have to pay individual income tax. His salary is RMB 18,000 per month, consists of RMB 13,000 base salary, with RMB 5,000 housing allowance.

一位外籍人士在宁波工作符合居民身份,因此需要缴纳个人所得税。他的薪资是每月18000元,包括13000元基本工资以及5000住房补贴

Taking the remuneration package unchanged since 2021 to 2022, then,

假设整个薪资包在2021年与2022年均没有改变,那么:

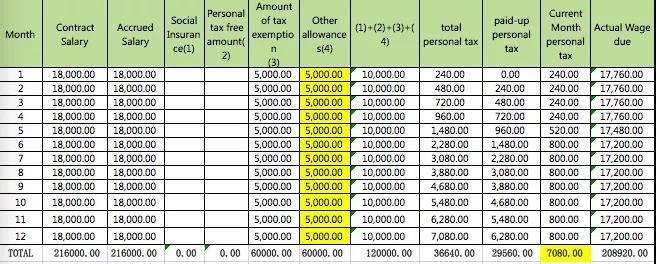

In 2021, he chose to enjoy the foreigners special treatment on income tax, every month, his housing allowance of RMB 5,000 will be deducted before calculating income tax payable. After calculation as below, his annual income tax would be RMB 7,080.

2021年,他选择享受外国人在个税上的特殊优惠,每月,他的住房补贴为5000元,将会在计算个人所得税之前扣除。在经过如下图所示的计算之后,他的年个税缴纳金额为7080元。

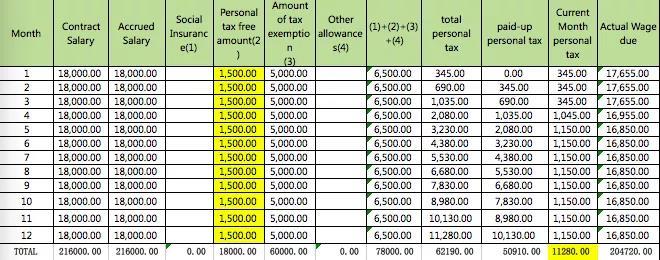

In 2022, he can only use the individual income tax special additional deduction, on the housing expenses. In Ningbo, the fixed deduction amount on housing is maximum RMB 1500 per month, therefore as the calculation below, annual income tax would be RMB 11,280, increased from last year.

在2022年,他只能使用个人所得税专项附加扣除住房相关项目。在宁波,固定最高额度的扣除为1500元每月,于是,年个税总计如下图计算为11280元, 较上年增加。

Of course the case would be more complicated, especially when the expats used to enjoy multiple allowances such as children’s education, the tuition fee can be easily up to RMB 200,000 to 300,000 per child per year. This change of tax policy seems to affect more to the high income expats lives in big cities.

当然,在实际案例中会更复杂,尤其当外籍人士享受多种补贴,例如子女教育费,一个孩子一年可以高达20至30万元。这次税收政策的改变将会更多的影响在大城市生活的高收入人士。

Nevertheless, paying tax is an obligation, but saving money legally on tax can be done with professional knowledge. Either as an employee or as an employer, sometimes with the optimal combination of remuneration package, you can all save a substantial amount of tax money.

不论如何,缴税时应尽义务,但是合法避税却需要专业知识。不论是作为雇员还是雇主,有时候使用最优的薪资组合,你可以在税额上省下一大笔钱。

Contact us for professional taxation consultation.

联系我们获得专业的税务咨询。