Cross border e-commerce

According to eMarketer, the market size ofcross-border retail e-commerce sales in China was US$78.5 billion in 2016, andthis figure is expected to exceed US$140 billion by 2021.

The growing awareness of and exposure to overseas brands in China, as well as the perception of “better” quality foreign goods have contributed to this trend. The latter factor is particularly the case for key product categories such as baby and maternity, health and beauty, nutrition and organic products.

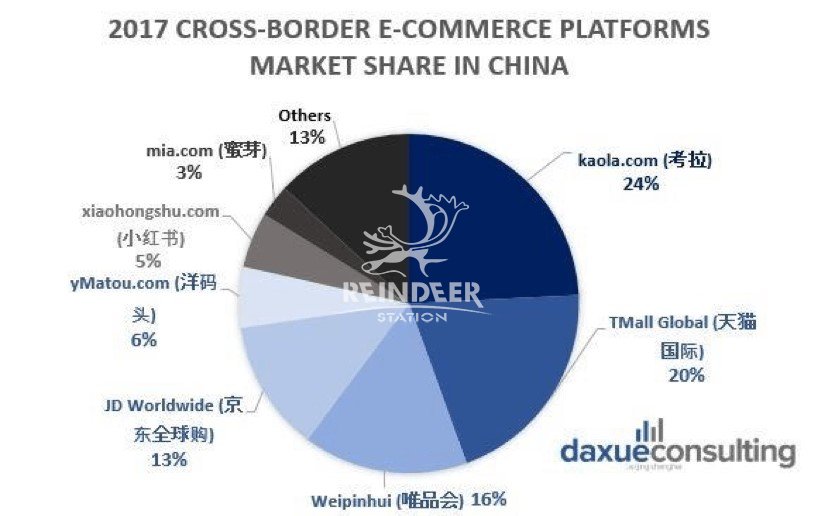

Currently, there is also a more diversified cross-border market in China, with players such as Kaola (考拉), Weipinhui (唯品会), Little Red Book (小红书) and yMatou (洋码头)competing with dominant players such as Alibaba’s cross-border e-commerce platform, Tmall Global (天猫国际) and JD’s platform, JD Worldwide (京东全球购).

What this trend essentially means is that there are now many opportunities for foreign businesses to break into the largest consumer market in the world.

(Source: Marketing to China)

(Source: Marketing to China)

Increase in information partnerships

With cross border retail e-commerce sales rapidly growing (and with no signs of it stopping), it is no surprise that businesses around the world want a piece of the pie.

However, breaking into the crowded retail market in China is no mean feat. Establishing a brand’s presence in the Chinese market requires effective marketing strategies, but more importantly, information and data.

Nestlé, for instance, partnered with Alibaba topersonalise the content on their Nestlé Tmall stores based on consumers’ data. Other companies such as Unilever, Mars and Hershey’s have also partnered with Alibaba to leverage data driven marketing solutions.

Likewise, LEGO forged an information partnership with Tencent this year, allowing the toy company to gain access to Tencent’s deep dataset of customer data for the customisation of its marketing efforts and develop a new digital platform to market its products.

New retail

In 2016, founder and executive chairman of Alibaba Group Jack Ma introduced the term “new retail”, and it has been a hot topic among manufacturers and retailers since.

The concept of new retail emphasises the merging ofboth online and offline elements, such as logistics, big data, products,services and marketing. In other words, new retail uses technology and data tomerge online and offline shopping to create a more efficient and flexible shopping experience for consumers.

An apt example of a successful online to offline (O2O)model is Hema Supermarket (盒马鲜生). TheHema experience begins with downloading the mobile app, which links to theuser’s Taobao or Alipay account.

Consumers are then able to purchase fresh foods, imported goods and dining services (just like in other physical supermarkets)through the Hema app. What’s more, they can enjoy door-to-door deliveries within 30 minutes if they live nearby. Similarly, JD.com has launched a similar offering called 7Fresh, paving the way for more players to enter the O2O space.

As China is increasingly becoming a significant market for imported goods, especially among the middle-to-high income consumer groups, foreign brands can look toward new retail as a promising opportunity. Aside from the new models and tech applications that come with new retail, new products are continually being introduced in China – which is something international brands can leverage.

For more information and consultation regarding setting up an online business in China, feel free to reach out to ReindeerStation.

References: eMarketer, Marketing to China, World Economic Forum, PwC total retail survey, Clickz, ZDNet, Deloitte China

———— / END / ————

CONTACT US

Reindeer Station Expat Service Co., Ltd

宁波灵达涉外服务有限公司

Adress

303, 3rd Floor, Lao Wai Tan Business Building,

No.15, Chezhan Rd., Jiangbei District, Ningbo, China

(next Ningbo Museum of Art)

E-mail

inquiry@reindeerstation.com

Tel

+86 574 2772 6526 / 2772 1008