Q

What is an annual one-time bonus?

什么是全年一次性奖金?

A

An annual one-time bonus refers to the bonus paid by withholding agents, such as administrative agencies and enterprises, to employees based on a comprehensive assessment of their annual economic performance and work achievements.

This one-time bonus also includes year-end salary increases, as well as the annual salary and performance pay that units implementing an annual salary system and performance pay system distribute based on assessments.

全年一次性奖金是指行政机关、企事业单位等扣缴义务人根据其全年经济效益和对雇员全年工作业绩的综合考核情况,向雇员发放的一次性奖金。

上述一次性奖金也包括年终加薪、实行年薪制和绩效工资办法的单位根据考核情况兑现的年薪和绩效工资。

Q

Can a semi-annual bonus be considered an annual one-time bonus?

取得的半年奖可以视为全年一次性奖金吗?

A

No, it cannot. The "Notice from the State Administration of Taxation on Adjusting the Method for Calculating Individual Income Tax on Annual One-Time Bonuses and Other Income" (Guo Shui Fa [2005] No. 9) stipulates that bonuses received by employees under various names, such as semi-annual bonuses, quarterly bonuses, overtime bonuses, performance awards, attendance awards, etc., other than the annual one-time bonus, must be combined with the monthly salary and taxed according to tax regulations.

不可以。《国家税务总局关于调整个人取得全年一次性奖金等计算征收个人所得税方法问题的通知》(国税发〔2005〕9号)规定:雇员取得除全年一次性奖金以外的其他各种名目奖金,如半年奖、季度奖、加班奖、先进奖、考勤奖等,一律与当月工资、薪金收入合并,按税法规定缴纳个人所得税。

Q

I have a year-end bonus that is paid out in both the first half and the second half of the year. Can they be combined as an "annual one-time bonus"?

我有一笔年终奖,分别在上半年和下半年发放,能不能合起来算作“全年一次性奖金”?

A

No, they cannot. The "Notice from the State Administration of Taxation on Adjusting the Method for Calculating Individual Income Tax on Annual One-Time Bonuses and Other Income" (Guo Shui Fa [2005] No. 9) stipulates that within a single tax year, this method of taxation is permitted to be applied only once for each taxpayer. Bonuses paid in different months cannot be combined into one.

不可以。《国家税务总局关于调整个人取得全年一次性奖金等计算征收个人所得税方法问题的通知》(国税发〔2005〕9号)规定:在一个纳税年度内,对每一个纳税人,该计税办法只允许采用一次。不同月份的奖金不能合并为一次。

Q

How is personal income tax calculated on the annual one-time bonus issued?

发放的全年一次性奖金,如何计算缴纳个人所得税?

A

There are two methods for taxation:

有两种计税方式:

1

Separate Taxation 单独计税

If a resident individual receives an annual one-time bonus that complies with the provisions of the "Notice from the State Administration of Taxation on Adjusting the Method for Calculating Individual Income Tax on Annual One-Time Bonuses and Other Income" (Guo Shui Fa [2005] No. 9) and prior to December 31, 2027, does not combine it with the annual comprehensive income, the annual one-time bonus income is divided by 12 months to obtain an average amount. The applicable tax rate and quick deduction amount are determined according to the monthly converted comprehensive income tax rate table attached to the "Notice from the Ministry of Finance and the State Administration of Taxation on Issues Related to the Transition of Preferential Policies Following the Amendment of the Individual Income Tax Law" (Cai Shui [2018] No. 164), and tax is calculated separately.

The calculation formula is: Tax payable = Annual one-time bonus income × Applicable tax rate - Quick deduction amount.

居民个人取得全年一次性奖金,符合《国家税务总局关于调整个人取得全年一次性奖金等计算征收个人所得税方法问题的通知》(国税发〔2005〕9号)规定的,在2027年12月31日前,不并入当年综合所得,以全年一次性奖金收入除以12个月得到的数额,按照《财政部 税务总局关于个人所得税法修改后有关优惠政策衔接问题的通知》(财税〔2018〕164号)所附按月换算后的综合所得税率表,确定适用税率和速算扣除数,单独计算纳税。

计算公式为:应纳税额=全年一次性奖金收入×适用税率-速算扣除数。

2

Combined Comprehensive

Income Taxation

并入综合所得计税

A resident individual receiving an annual one-time bonus may also choose to combine it with the current year's comprehensive income for tax calculation.

居民个人取得全年一次性奖金,也可以选择并入当年综合所得计算纳税。

Q

Which taxation method is more advantageous for the annual one-time bonus?

全年一次性奖金,选择哪种计税方式更划算?

A

During the annual settlement period, when choosing the taxation method for the annual one-time bonus, it is recommended that you select the one that is more beneficial based on your individual circumstances.

You can log in to the Personal Income Tax APP, and during the settlement declaration, you can choose either the combined taxation method or the separate taxation method. The APP will automatically calculate the results, allowing you to compare and choose the more advantageous taxation method.

年度汇算期间,在选择全年一次性奖金计税方式时,建议您根据自身情况,选择对您更为有利的计税方式。

您可以登录个人所得税APP,在汇算申报时分别选择按合并计税或单独计税方法,个税APP会自动算出结果,对比结果再选择更有利的计税方式即可。

Case 案例

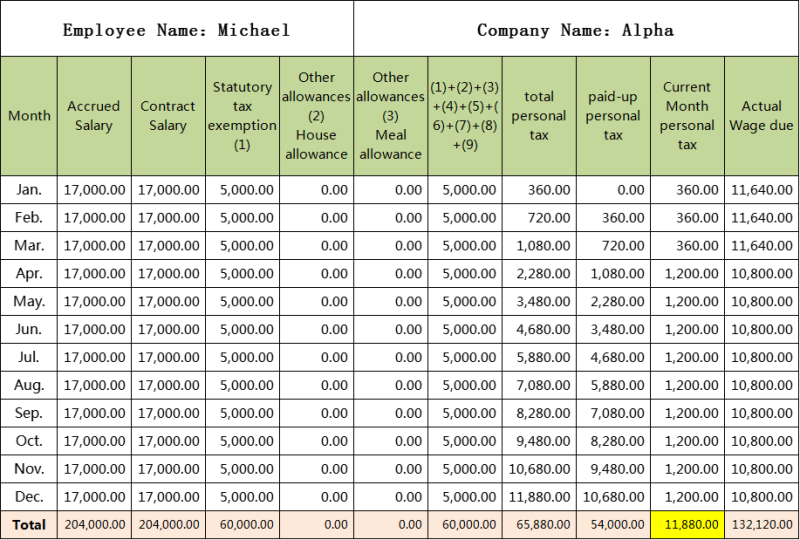

Foreign employee Michael worked for the Chinese company Alpha in the year 2023, with a fixed monthly salary of 17,000 yuan before tax, and did not enjoy any tax benefits from housing or meal allowances. The details of Michael's salary income and the tax withheld by the company Alpha are as follows:

外籍员工Michael在2023年度任职于中国公司Alpha,每月税前固定薪水为17000元,且没有享受住房补贴和餐饮补贴的税收优惠政策,那么,Michael在公司Alpha的工资薪金收入和代扣代缴税款明细如下:

Explanation (in the absence of an annual one-time bonus):

① Total accrued salary for the year = 204,000 yuan

② Annual statutory tax exemption = 60,000 yuan

③ Taxable income for the year = 204,000 - 60,000 = 144,000 yuan

④ Taxable amount (from monthly fixed salary) = Taxable income for the year × Tax rate - Quick deduction amount

= 144,000 × 10% - 2,520 = 11,880 yuan

说明(不存在全年一次性奖金时):

①全年应计薪水(Accrued Salary) = 204000元,

②全年法定免税额(Statutory tax exemption) = 60000元,

③全年应纳税所得额 = 204000 - 60000 = 144000元

④(每月固定薪水)应纳税额 = 全年应纳税所得额 × 税率 - 速算扣除数

= 144000 × 10% - 2520 = 11880元

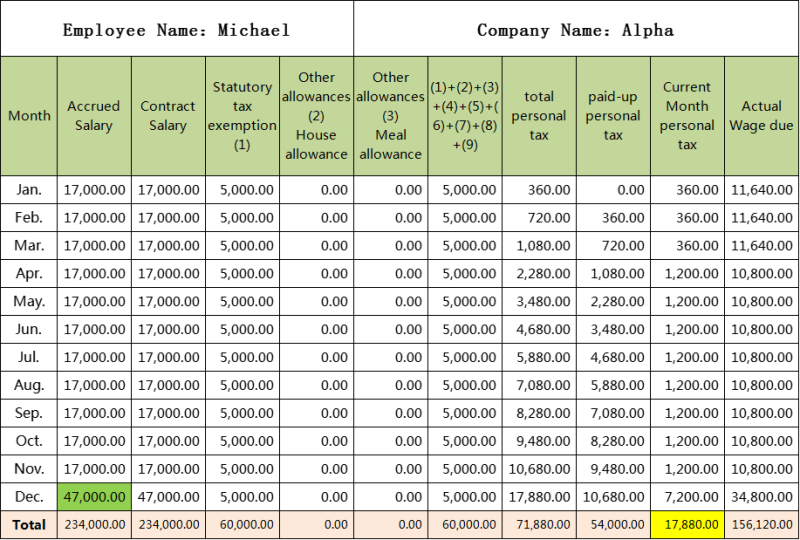

If in December 2023, Michael receives an annual one-time bonus of 30,000 yuan.

如果2023年12月,Michael获得全年一次性奖金30000元。

1

Separate Taxation 单独计税

① Total accrued salary for the year = 204,000 yuan

② Annual statutory tax exemption = 60,000 yuan

③ Taxable income for the year = 204,000 - 60,000 = 144,000 yuan

④ Taxable amount (from monthly fixed salary) = Taxable income for the year × Tax rate - Quick deduction amount

= 144,000 × 10% - 2,520 = 11,880 yuan

⑤ Taxable amount (from annual one-time bonus) = Monthly received annual one-time bonus × Applicable tax rate - Quick deduction amount

= 30,000 × 3% - 0 = 900 yuan

⑥ Total taxable amount for all items in the year = 11,880 + 900 = 12,780 yuan

①全年应计薪水(Accrued Salary) = 204000元,

②全年法定免税额(Statutory tax exemption) = 60000元,

③全年应纳税所得额 = 204000 - 60000 = 144000元

④(每月固定薪水)应纳税额 = 全年应纳税所得额 × 税率 - 速算扣除数

= 144000 × 10% - 2520 = 11880元

⑤(全年一次性奖金)应纳税额=当月取得全年一次性奖金×适用税率-速算扣除数

=30000 × 3% - 0 = 900元

⑥全年所有项目应纳税额 = 11880 + 900 = 12780元

2

Combined Comprehensive

Income Taxation

并入综合所得计税

Explanation (in the presence of an annual one-time bonus):

① Total accrued salary for the year = 234,000 yuan

② Annual statutory tax exemption = 60,000 yuan

③ Taxable income for the year = 234,000 - 60,000 = 174,000 yuan

④ Total taxable amount for all items in the year = Taxable income for the year × Tax rate - Quick deduction amount

= 174,000 × 20% - 16,920 = 17,880 yuan

说明(存在全年一次性奖金时):

①全年应计薪水(Accrued Salary) = 234000元,

②全年法定免税额(Statutory tax exemption) = 60000元,

③全年应纳税所得额 = 234000 - 60000 = 174000元

④全年所有项目应纳税额 = 全年应纳税所得额 × 税率 - 速算扣除数

= 174000 × 20% - 16920 = 17880元

Clearly, in this case, 【1: Separate Tax Calculation】 is preferable to 【2: Tax Calculation Based on Comprehensive Income】.

显然,此时【方式一:单独计税】更优于【方式二:并入综合所得计税】。

Summary Generally speaking, if annual income is high and the goal is to reduce tax burden, one might choose the separate tax calculation method. If annual income is not high or there are significant tax benefits, the comprehensive income tax method may be more appropriate.

总结 一般来说,如果年收入较高且希望降低税负,可以选择单独计税方式;如果年收入不高或存在较多税收优惠的情况下,则选择综合计税方式可能更为合适。

Q

How is the period for the annual one-time bonus determined?

全年一次性奖金如何确定所属期?

A

The annual one-time bonus belongs to the year in which it is issued. The "year" for annual tax settlement refers to the tax year, which runs from January 1 to December 31 of the calendar year.

During the annual tax settlement, the income and deductions are based on the actual income received and the expenses or expenditures that meet the conditions or stipulated standards within that time frame.

For example, if an organization distributes the year-end bonus for 2023, if it is issued at the end of 2023, it is considered income for the 2023 tax year; if it is issued in January 2024, it will be considered income for the 2024 tax year.

全年一次性奖金在哪个年度发放就属于哪个年度。年度汇算的“年度”即为纳税年度,也就是公历1月1日起至12月31日。

年度汇算时的收入、扣除,均为该时间区间内实际取得的收入和实际发生的符合条件或规定标准的费用或支出。

如某单位要发放2023年的年终奖,如果2023年年底发放则属于2023年度的收入;如果2024年1月发放则属于2024年度的收入。

Author 作者 | Alex