From March 1, 2024, to June 30, 2024, all foreign tax residents in China with total income exceeding 120,000 RMB/year are required to complete the individual income tax settlement and payment. If they have multiple sources of income, how should they pay taxes exactly? Reading this article will help you understand clearly how to calculate and pay the taxes.

2024年3月1日至2024年6月30日,所有在华有总收入超过12万元人民币每年的税收居民外籍个人都必须完成个人所得税汇算清缴。但是有多项收入,这个税到底该怎么缴呢?自己的帐看懂这篇文章可以算的明明白白了!

CASE

案例

For foreign individuals like Michael, who worked for two Chinese companies Alpha and Beta in 2023 and had monthly income tax withheld by both companies.

外籍员工Michael在2023年度任职于两家中国公司Alpha和Beta,两家公司每个月都在为Michael代扣代缴工资薪金个人所得税。

1

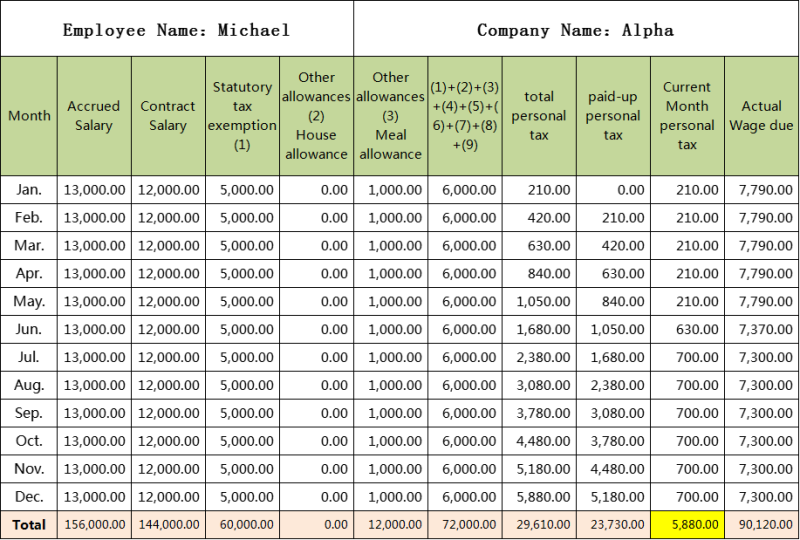

Here is the breakdown of Michael's income and the details of tax withheld by company Alpha:

Michael在公司Alpha的收入和代扣代缴税款明细如下:

Company Alpha :

Annual Accrued Salary = 156000 RMB

Annual Statutory Tax Exemption = 60000 RMB

Annual House Allowance = 0 RMB

Annual Meal Allowance = 12000 RMB

Annual Taxable Income = 156000 - 60000 - 0 - 12000 = 84000 RMB

Annual Individual Income Tax

= Annual Taxable Income × Tax Rate - Quick Calculation Deduction

= 84000 × 10% - 2520 = 5880 RMB

Alpha公司:

全年应计薪水= 156000元

全年法定免税额 = 60000元

全年租房补贴 = 0元

全年餐费补贴 = 12000元

全年应纳税所得额 = 156000 - 60000 - 0 - 12000 = 84000元

全年应纳个人所得税额

= 全年应纳税所得额 × 税率 - 速算扣除数

= 84000 × 10% - 2520 = 5880元

2

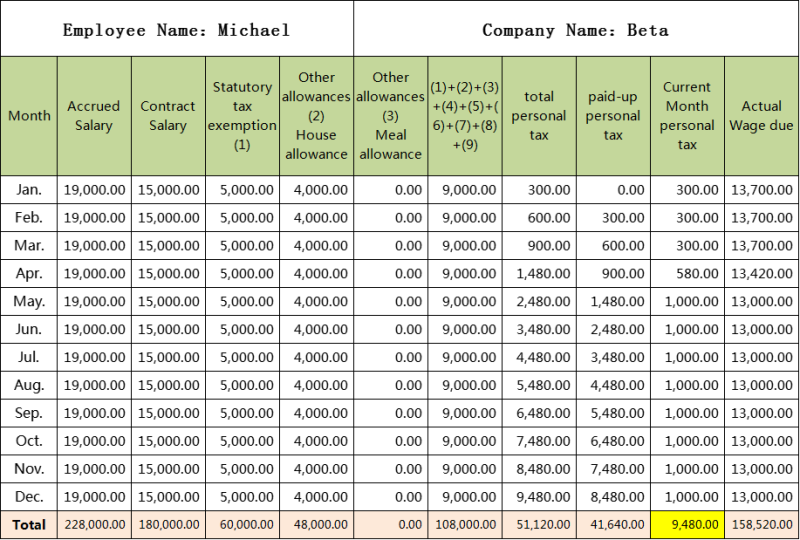

Here is the breakdown of Michael's income and the details of tax withheld by company Beta:

Michael在公司Beta的收入和代扣代缴税款明细如下:

Company Beta:

Annual Accrued Salary = 228000 RMB

Annual Statutory Tax Exemption = 60000 RMB

Annual House Allowance = 48000 RMB

Annual Meal Allowance = 0 RMB

Annual Taxable Income = 228000 - 60000 - 48000 - 0 = 120000 RMB

Annual Individual Income Tax

= Annual Taxable Income × Tax Rate - Quick Calculation Deduction

= 120000 × 10% - 2520 = 9480 RMB

Beta公司:

全年应计薪水 = 228000元

全年法定免税额 = 60000元

全年租房补贴 = 48000元

全年餐费补贴 = 0元

全年应纳税所得额 = 228000 - 60000 - 48000 - 0 = 120000元

全年应纳个人所得税额

= 全年应纳税所得额 × 税率 - 速算扣除数

= 120000 × 10% - 2520 = 9480元

3

From March 1, 2024, to June 30, 2024, Michael must complete the settlement and payment of his individual income tax. His total salary income from Alpha and Beta in 2023 will be summarized and used to calculate the total annual individual income tax due. This calculated amount will then be compared to the individual income tax already withheld by the two companies. If the "total calculated tax amount" is greater than the "total tax withheld by the companies" , Michael will need to make up the difference by paying additional individual income tax.

2024年3月1日至2024年6月30日,Michael必须完成个人所得税汇算清缴,对其2023年在Alpha和Beta的所有薪水收入进行汇总,合并计算全年应缴纳的个人所得税,并将计算结果与两家公司已代扣代缴的个人所得税进行比较。如果“汇总计算的税额”>“各公司代扣代缴的税额合计”,那么Michael就需要补缴个人所得税。

After combining the total income and withholding tax payments of companies Alpha and Beta, the details are as follows:

将公司Alpha和Beta的总收入和代扣代缴税款合并后,明细如下:

Company Alpha & Company Beta:

Annual Accrued Salary = 156000 + 228000 = 384000 RMB

The following three tax exemption policies cannot be duplicated for all foreign employees:

-

Annual Statutory Tax Exemption = 60000 RMB(Select Alpha or Beta Company)

-

Annual House Allowance = 48000 RMB(Select Beta Company)

-

Annual Meal Allowance = 12000 RMB(Select Alpha Company)

Consolidated Annual Taxable Income = 384000 - 60000 - 48000 - 12000 = 264000 RMB

Consolidated Annual Individual Income Tax

= Annual Taxable Income × Tax Rate - Quick Calculation Deduction

= 2640000 × 20% - 16920 = 35880 RMB

Alpha Company Annual Individual Income Tax = 5880 RMB

Beta Company Annual Individual Income Tax = 9480 RMB

Add up the two:5880 + 9480 = 15360 < 35880 RMB

Therefore, Michael needs to make up the individual income tax for the year 2023.

= 35880 - 15360

= 20520 RMB

Alpha公司 & Beta公司:

全年应计薪水 = 156000 + 228000 = 384000元

下面三项免税政策,所有外籍员工都不能重复享受:

-

全年法定免税额 = 60000元(选择Alpha或Beta公司)

-

全年租房补贴 = 48000元(选择Beta公司)

-

全年餐费补贴 = 12000元(选择Alpha公司)

合并后全年应纳税所得额 = 384000 - 60000 - 48000 - 12000 = 264000元

合并后全年应纳个人所得税额

= 全年应纳税所得额 × 税率 - 速算扣除数

= 2640000 × 20% - 16920 = 35880元

Alpha公司全年应纳个人所得税额 = 5880元

Beta公司全年应纳个人所得税额 = 9480元

两者相加:5880 + 9480 = 15360 < 35880元

所以,Michael还需要补缴2023年度个人所得税

= 35880 - 15360

= 20520元

NOTE 注意

1."Resident foreign individuals" must participate in the annual individual income tax settlement and payment declaration to ensure they have no tax risks. "Resident foreign individuals" refer to individuals who have a domicile within China or who have resided in China for an accumulated total of 183 days or more within one tax year without a domicile.

1.“居民外籍个人”,就必须参加个人所得税汇算清缴的申报,以确保自己没有税务风险。“居民外籍个人”,是指在中国境内有住所,或者无住所而一个纳税年度内在中国境内居住累计满183天的个人。

2.How to pay taxes? In general, company employees can declare the annual individual income tax settlement and payment using the "Individual Income Tax APP". However, as Michael is a foreign national, before using the "Individual Income Tax APP" for the first time, Michael must personally bring his passport to the tax office to complete the "real-name authentication" procedure (obtain registration code + facial recognition). After completing the procedure, Michael can register and log in to the "Individual Income Tax APP" personal account to declare the annual individual income tax settlement and payment.

2.如何缴纳?一般情况下,公司员工可以在“个人所得税APP”里进行“个人所得税汇算清缴”的申报。但由于Michael是外籍人士,在第一次使用“个人所得税APP”前,Michael必须亲自携带护照去税务大厅办理“实名认证”手续(获取注册码 + 人脸识别)。在手续办理完成后,Michael就可以注册并登录“个人所得税APP”个人账户进行“个人所得税汇算清缴”的申报。

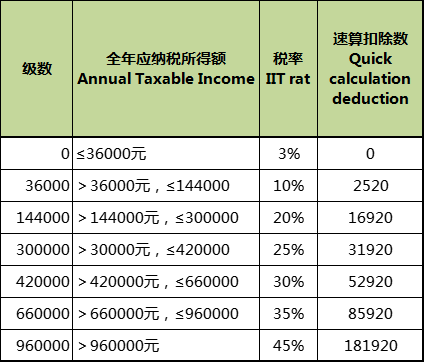

3.Tax rates?Individual income tax is levied using a progressive tax rate ranging from 3% to 45% on comprehensive income exceeding certain thresholds. Comprehensive income includes detailed items such as wages, salaries, and labor compensation. To simplify calculations, tax rates and quick deduction amounts are usually used together. Below is the tax rate table for wage and salary income.

3.纳税标准?个人所得税的综合所得适用3%至45%的超额累进税率。综合所得,包括工资薪金所得、劳务报酬所得等明细项目。为了计算简便,通常会将“税率”和“速算扣除数”一起使用。下面是工资薪金所得的税率表。

Author 作者 | Alex